Analysis

Is Robinhood doomed to fail?

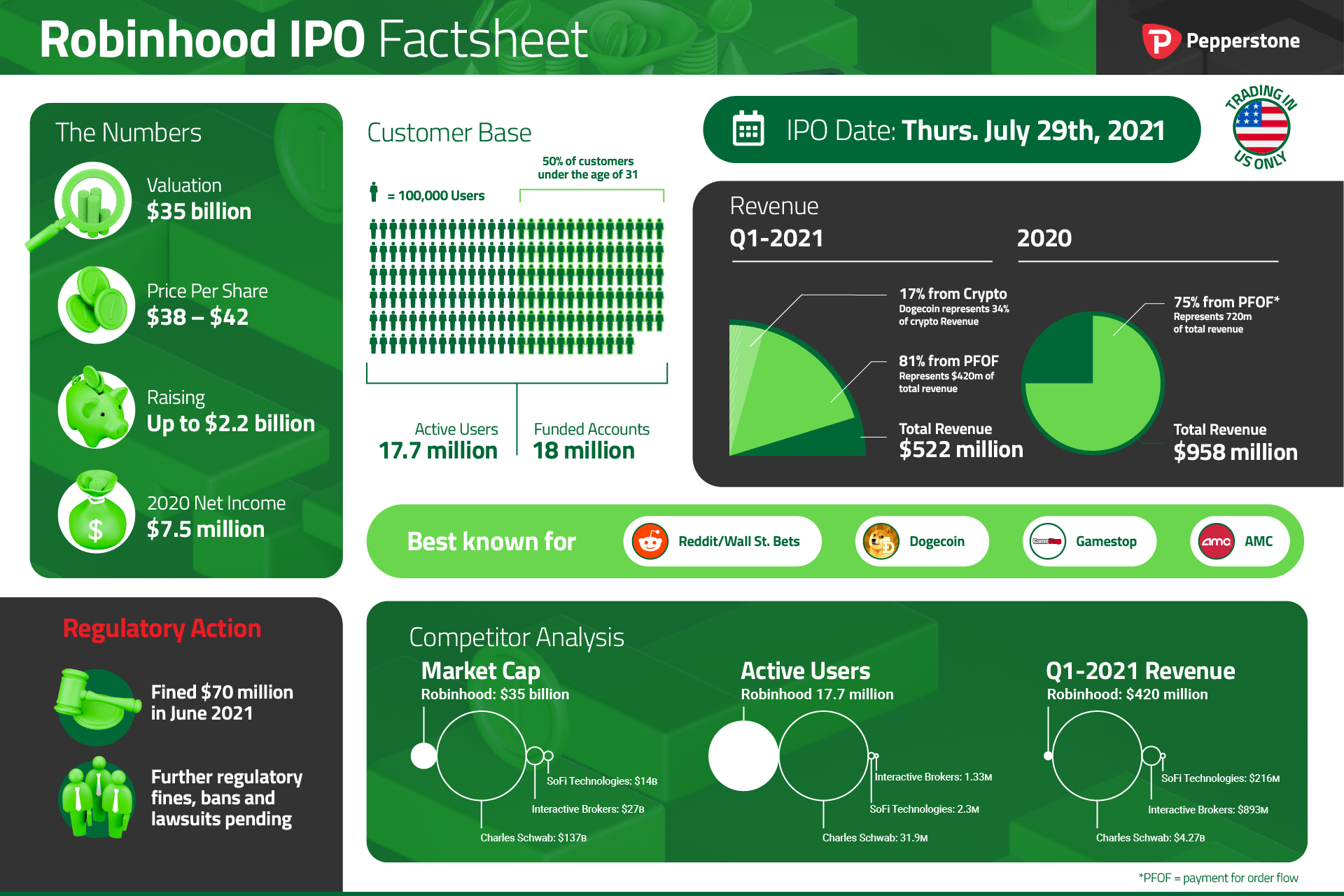

They need to justify a $35 billion valuation at a time when its drawn the ire of regulators and seasoned market veterans alike, all while staring down the barrel of a litany of impending lawsuits. The gavel has just fallen on a $57 million FINRA fine and $13 million in client repayments for inadequate platform maintenance and a lack of due diligence and transparency in relation to its options trading business, and one suspects this to be just another episode in the saga.

Where we see significant viability concerns, however, is in its business model; payment for order flow (PFOF). It’s ethically questionable and regulators have the practise in their sights. Significant changes to the regulatory framework, or even straight up PFOF bans, could render the Robinhood business model obsolete. Further, we need to ask a crucial question - what would happen if the pin was pulled on the Citadel relationship?

The backdrop of the IPO, a market leader listing at what seems to be a very favourable moment for the industry and equities in general, should also pique interest. Will the Robinhood IPO set the top for the retail trading market and the meme frenzy?

It may prove to be a great shorting opportunity, especially in the short term, but the fact that opinion is so clearly divided about it’s investment attraction makes it such an exciting trading opportunity whichever way it goes. Here’s why.

Legal & regulatory woes

For a company set to list at a $30-40 billion dollar valuation, you’d hope it wasn’t facing some serious regulatory uncertainty. But alas, Robinhood is staring down the barrel of increased regulatory oversight, reform and fines. Regulators hate them. Enhanced compliance obligations and restrictions on what a business can do to sell its product can have a serious impact on the bottom line. It doesn’t exactly inspire investor confidence, investors don’t want to put their money where there’s heightened regulatory risk.

Here’s a list of the legal and regulatory troubles it faces, for now:

Compliance

FINRA and the SEC are set to impose greater onboarding and ongoing due diligence requirements for their options business in light of the major failures they had earlier this year with their platforms (expect client base growth to take a hit). Most notably, they allowed clients who opted out of margin trading to do just that, and their losses exceeded their deposits. In many cases, the negative balances accrued by traders were shown to be double what the actual losses were.

In other more regulated derivatives markets, this would mean serious sanctions on the provider. It’s perhaps only because they act as an intermediary, and not an execution venue, that they have managed to come out of this incident unscathed. Best execution duties are a grey area since they don’t place trades on behalf of clients. This will likely be tightened.

Cryptocurrency

Concerns about their cryptocurrency anti-money laundering processes and cybersecurity. Expected to pay up to $15 million in fines. Crypto will undoubtedly see regulatory changes in the near future. Declines in crypto brokerage profitability may follow.

Payment for order flow

PFOF: rumours are swirling of restrictions and bans, with the SEC Commissioner, Gary Gensler, publicly voicing his disapproval given the conflict of interest it poses.

Lawsuits

The list of individual and class action lawsuits is staggering, having to defend more than 50 class actions and 3 individual lawsuits. Many of the class action cases relate to customers who were frozen out of their accounts amid the Gamestop meme frenzy, where it’s alleged that Robinhood prevented trading in the stock to save it’s hedge fund friends from massive losses on their short positions, and to raise capital in order to meet withdrawal requests amid huge losses.

Investigations

The company’s CEO, Vlad Tenev, fronted a Senate hearing into the matter to explain the company’s blatant disregard for clients. And then authorities executed a warrant to seize his phone to look into the same matter…not a great sign.

Business model viability

As previously mentioned in our earlier Robinhood article, Robinhood relies on PFOF for the majority of its revenue, up to 81% in Q1. While it claims not to charge clients a commission on trades, it really does, just indirectly. Trading isn’t free, and it isn’t supposed to be. Somewhere, someone is taking on the risk of client orders. The fee paid for this is spread. Robinhood makes its money through PFOF by taking a cut of the spread that its hedge fund counterparties receive.

That means it has a vested interest in selling retail client flow to the highest bidder, i.e. those that are willing to give it a larger chunk of the spread. In this case, it's Citadel that they are sending a lion share of flow to, as much as 31% last year. Robinhood claims that it sends client orders to those counterparties which it believes to give the best pricing based on a range of factors, but if it were bound by best execution requirements and forced to aggregate pricing to give clients the best fills possible, its revenue would more than likely decline.

It's for this reason that the SEC and other government agencies have the practise on their radar. The very model that Robinhood claims to ‘democratise finance for all’ and include retail traders in the investment process is also allowing it to make huge sums at their expense. Robinhood’s own SEC IPO filing alludes to the fact that any changes to PFOF regulations could result in a major change in its business model, from which it may not recover. Surely this will not be skipped over by investors. It’s a glaring red flag.

Surprising as it is dumbfounding is the fact that while the conflicted remuneration structure it operates on is well known within the investment community, that has not translated to the same level of animosity among its active client base, the retail investor. They are largely unaware and don’t care much for how Robinhood makes its money for one simple fact: on the face of it, Robinhood charges them $0 in fees. But that could change one day, and when the penny drops on the retail community, it will fall hard on Robinhood’s bottom line.

Further, cryptocurrency transaction-based revenues are growing as a % of its total revenues, and more alarmingly, Dogecoin is what’s driving that. The joke token took the financial world by storm earlier this year, with its value increasing astronomically simply due to hype. There’s no fundamental use for it, it's literally a joke. And yet it accounted for 34% of its crypto revenues, meaning it could hold up to $4 billion worth on its books. If and when Dogecoin shoots back down to earth, expect their crypto revenue stream to shrink.

There’s also the matter of a waning pandemic influence on people’s lives. The US is opening back up, with almost 160 million people vaccinated (New York Times). Those that were driving the retail investment wave are now getting back to work, going out, spending time away from the internet and their homes. It could be argued that this drives people away from trading as they go about their lives with some level of previous normality. If true, Robinhood, like all brokers, would likely see a decline in trading volumes and activity across the board.

Top of the market?

An interesting thematic playing into this IPO is the timing of market leaders going public. If we look at some of the major IPOs over the past 2 decades, we can see somewhat of a trend forming where a major IPO marks the top of the underlying industry, and a spiral downwards ensues. Take the following as examples:

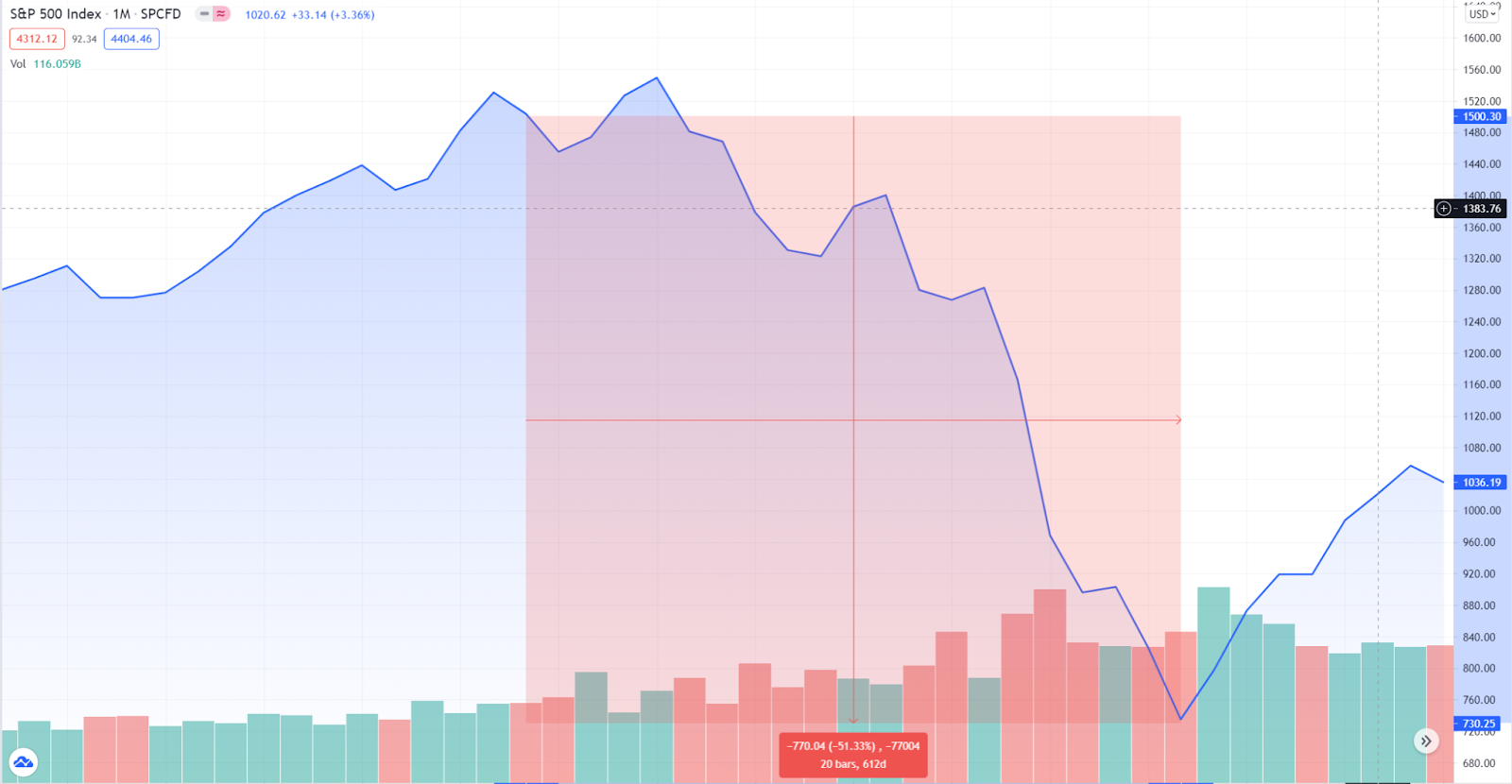

Blackstone

Lists June 2007 in the largest IPO since 2002. A private equity beast whose $30 billion valuation signaled the overwhelming strength of equity markets at the time. Not long after listing the GFC took off and the S&P saw a 51% decline over the next 600 days. It was ugly.

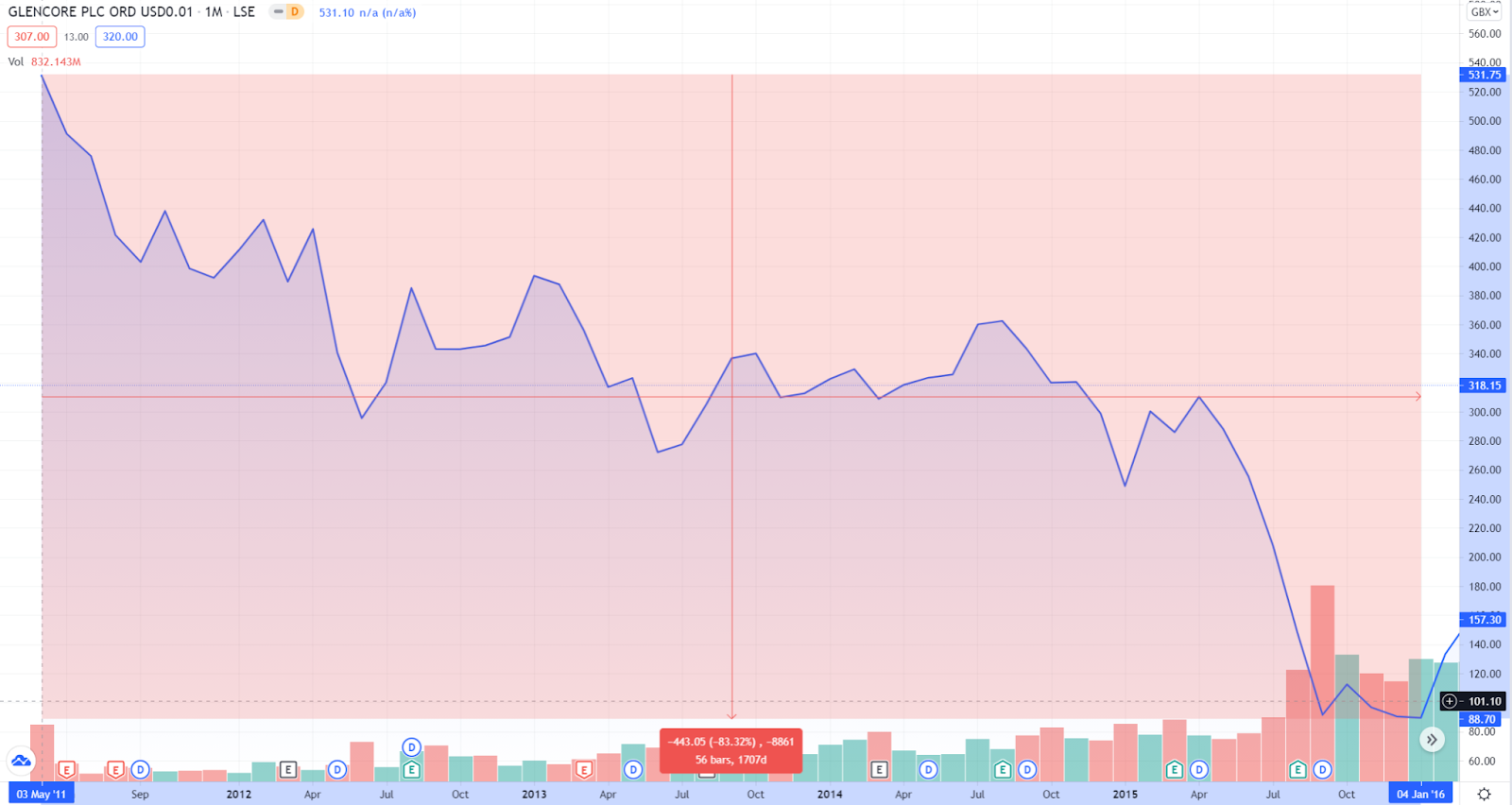

Glencore

The multinational mining company and commodity trading house listed on the London Stock Exchange with a valuation of around $60 billion in May, 2011. Over the course of the next 5 years, the wider metals and commodities sector saw a gradual decline of 50%. It’s share price tumbled by up to 80% over the same period.

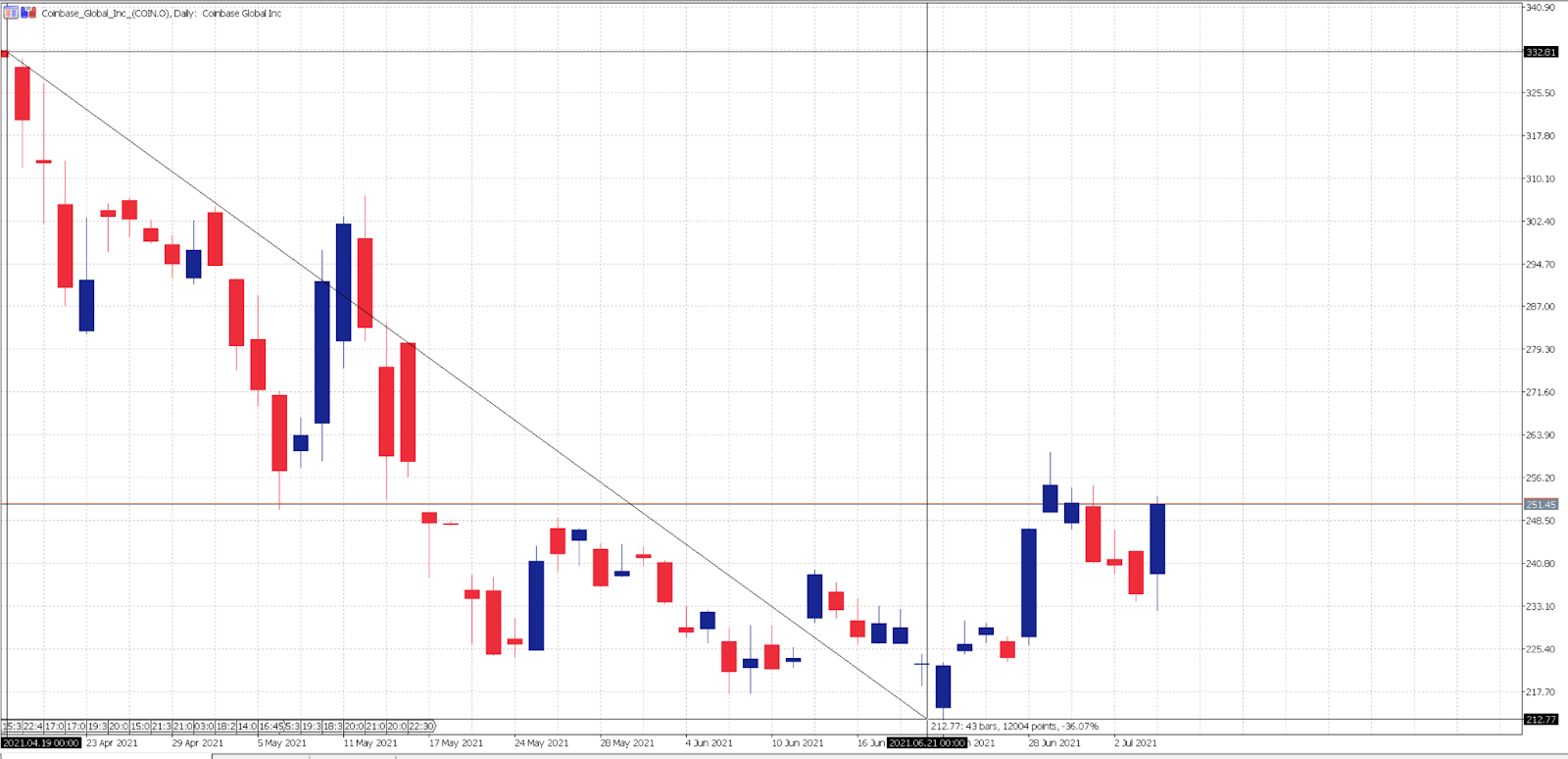

Coinbase

Most recently, the public offering of one of the largest cryptocurrency exchanges closed at a valuation of $86 billion on its first day of trading. That was mid April. It’s value declined by as much as 36% over the following 2 months after Bitcoin and the wider crypto market halved in value.

With these examples in mind, what does this mean for the fate of Robinhood and the meme stock? Is this a signal of excess in equity markets? It would not be farfetched to say this IPO may precede a continued period of decline in retail trading volumes and those businesses that are profiting from the retail trading boom, if history is anything to go by.

The meme stock revolution may be dead in the water, once retail traders have turned Robinhood into its own meme, that is. That’s a real possibility, with Reddit and other forums already heating up with questions about how retail can short Robinhood.

Upside potential

There is a train of thought, however, that with its financial backing, and the potential for it to have many of its lawsuits thrown out in court given the terms and conditions it makes clients sign, Robinhood will be able to absorb the short term costs of legal troubles while it transitions to a more transparent, trusted brand. If it can weather that storm, successfully navigate regulatory changes, and retain its loyal client base, steady revenue growth is still possible.

There’s no doubt that Robinhood has a product that appeals to a demographic of lower-value investors that are increasingly focussed on alternative ways to make passive income, and they are a powerhouse in organic client growth. If they can maintain their $15 customer acquisition cost, and continue to grow revenue per customer, they may well continue to be the preeminent company in the retail brokerage space.

But the jury is out on its future prospects.

Well, what now?

If you’re now wondering “well, how can I take a view on Robinhood in the short term and take advantage of volatility post-IPO?” - trading share CFDs on the stock are an option that Pepperstone will be one of the first to offer on the MT5 platform. Contracts for difference (CFDs) on shares, a derivative which enables you to trade the price differences in a company, give you a number of benefits:

- Go long or short, no need to borrow stock.

- No need to worry about complications with stock ownership

- Use leverage to get into your positions with less capital

- Trade fractional shares (as little as 0.1 shares per order)

- Competitive pricing: exchange spreads, volume fee of just $USD0.02 per share, $0 minimum commission

- All-in-one-access: trade CFDs on FX, Metals, Energy, Indices, Cryptos and more from the one account.

Of course, there are higher risks to your capital when trading with leverage and when you do not own the underlying asset, when not managed appropriately. So you should consider whether this investment vehicle is right for you, and you may want to consider only trading with money you can afford to lose. But trading CFDs on Robinhood are a great way to get involved in the post-IPO price action that the market is hotly anticipating.

And there’s no better place to trade than with Pepperstone. Sign up to trade today.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.