- English

- 中文版

What’s At Stake

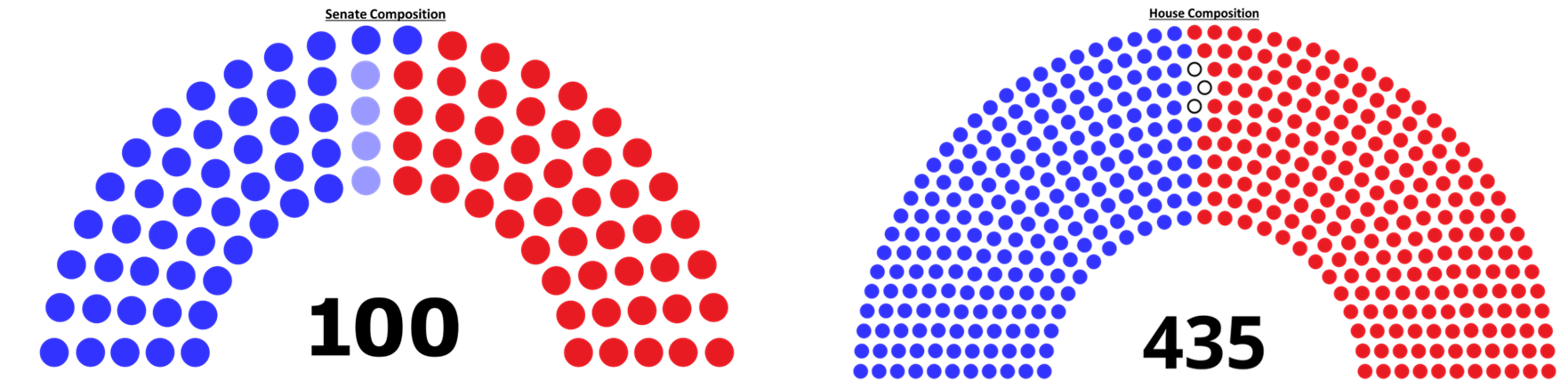

Of course, it is not only the Presidency that is on the ballot come November. Polling day also sees all 435 members of the House of Representatives up for re-election, while 34 Senate races will also take place. Incidentally, this will also be the first presidential election since 1976 when a Bush, a Clinton, or Joe Biden, won’t be on the ballot.

Currently, the Republicans (AKA, the GOP - Grand Old Party) hold a narrow majority in the House, while the Democrats control the Senate, by virtue of independent senators who caucus with the party, and VP Harris’ ability to make a casting vote, were it to be required.

Consequently, once the dust settles and votes are counted, this leaves us with four potential outcomes:

- ‘Blue Wave’ – The Democrats retain the Presidency, with Kamala Harris winning the Electoral College vote, while also gaining control of both chambers in Congress, retaining the Senate, and reclaiming the House

- Democratic President, Divided Congress – The Democrats retain the presidency with Kamala Harris, but do not have overall control of Congress, with the GOP holding a majority in one of, or both, the House and Senate

- Republican President, Divided Congress – Former President Trump returns to the White House, albeit without control of Congress, with the Democrats holding a majority in one of, or both, the House and Senate

- ‘Red Wave’ – Trump returns to the White House after a four year hiatus, becoming only the 2nd President to win a second non-consecutive term having been defeated in a re-election race, accompanied by a GOP majority in both the Senate, and the House

The Current Landscape

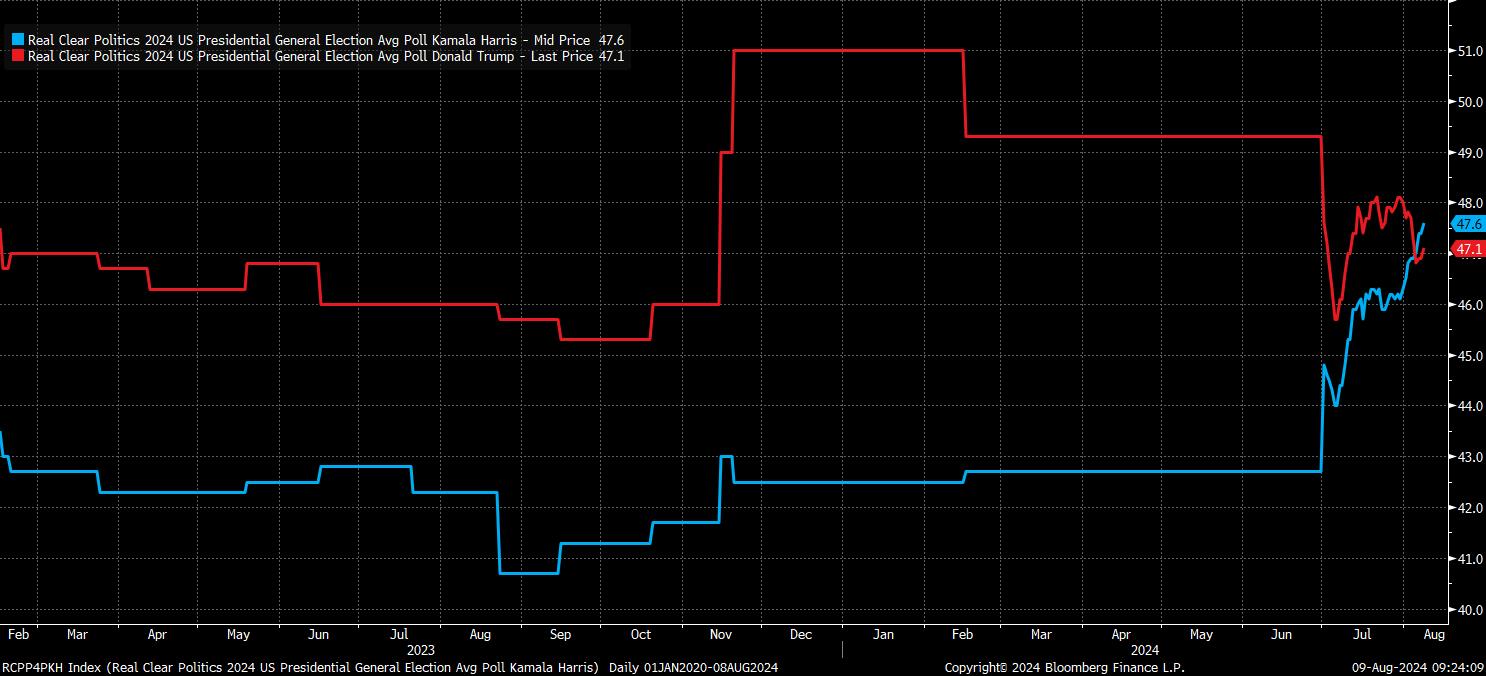

As mentioned, President Biden dropping out of the race, and his subsequent replacement by Kamala Harris, has seen the race step up a gear, with new media, and market, interest having been injected into the race, plus a surge in fundraising having taken place. The shake-up on the Democratic ticket has also seen polls narrow significantly, with Trump’s prior poll lead having shrunk, and the former President now even falling behind VP Harris in several recent nationwide voting intention polls.

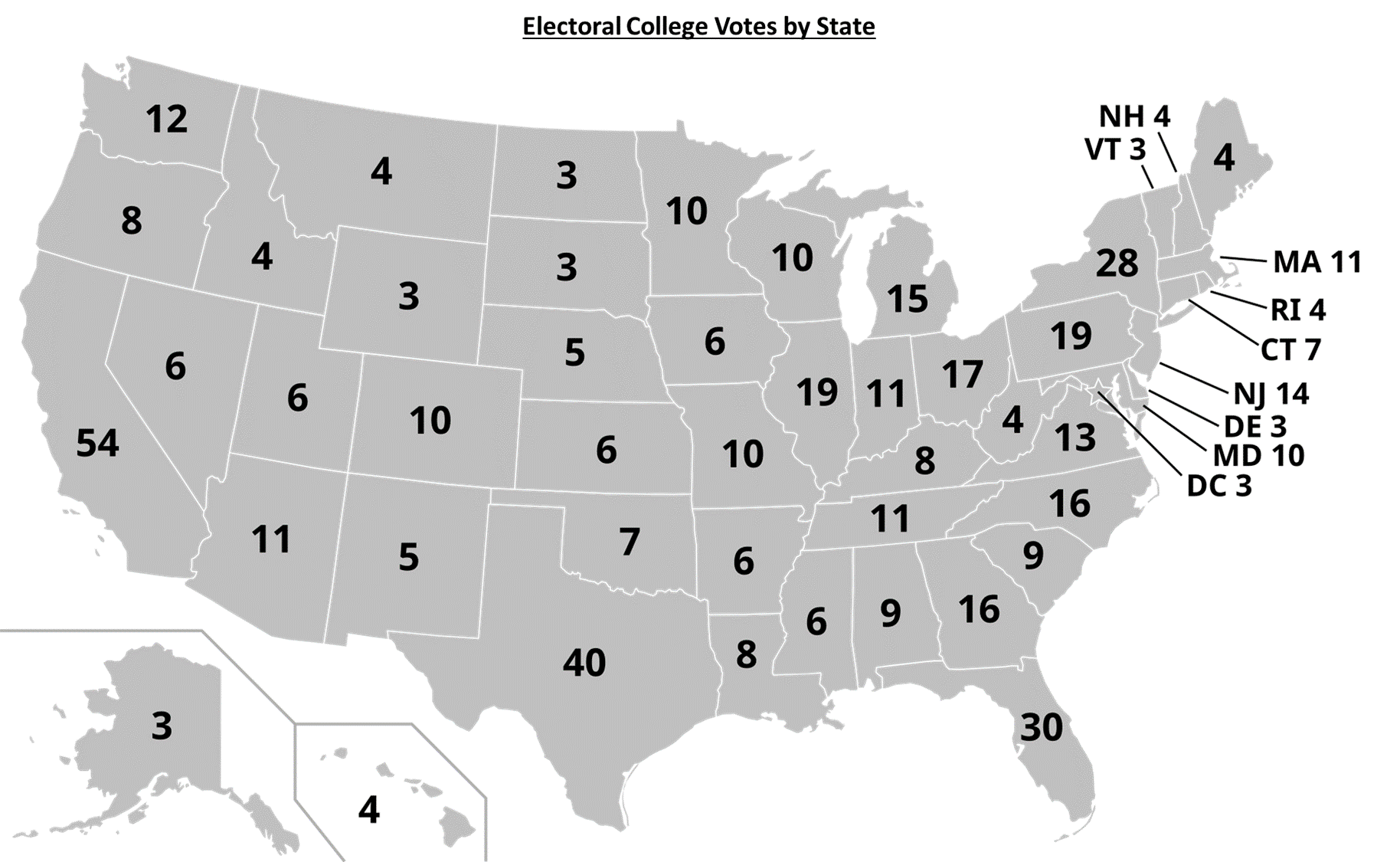

Headline voting intention, however, matters little, given the Electoral College system, whereby each state is given a number of electoral votes, equal to the sum of the number of Senators and its number of Representatives in the House. Typically, though not always, whichever candidate wins the most votes in a given state, wins all of that state’s electoral votes. The number of votes allocated to each state varies wildly, from California with 54, through to some smaller states in the Midwest with just 3 or 4 Electoral College votes each.

This creates a situation whereby it is not only how many votes a candidate wins that is important, but also where those votes are found – a broad base of voters across the country is key in plotting a path to the White House.

Furthermore, numerous states, given their demographic makeup, as well as historical voting trends, are considered as ‘safe’. This further narrows potential paths to victory and, in effect, leaves the election result in the hands of seven so-called ‘swing states’, those with the potential to vote either way come November. These are:

- Arizona (AZ)

- Georgia (GA)

- North Carolina (NC)

- Nevada (NV)

- Michigan (MI)

- Pennsylvania (PA)

- Wisconsin (WI)

Of course, that is not to say that other states may vote in a way that is atypical to historical trends. The Democrats, for instance, have long been attempting to win the Republican heartland of Texas, while former President Trump has struck a bullish tone in some interviews, stating his belief that he may be able to carry Democrat-leaning states such as Minnesota. In any case, the bulk of campaign activity will likely be focused on the aforementioned states, as campaigning where the result is already something of a foregone conclusion is considered by most political operatives as a waste of precious time, and resources.

According to the well-respected Cook Political Report, current state leanings point to the Republicans holding the upper hand when it comes to winning the ‘magic’ 270 votes required in order to win the presidency.

Consequently, with this small proportion of states likely holding the key to the overall election result, it is polling in these states that deserves close attention, as opposed to nationwide voting intention polls, which can paint a misleading picture.

At the time of writing, per RealClearPolitics, Trump has a lead in six of the seven key swing states, though these leads have narrowed in recent weeks, with some now within the margin of error:

- Arizona (AZ): Trump +2.8pts

- Georgia (GA): Trump +0.8pts

- North Carolina (NC): Trump +3.0pts

- Nevada (NV): Trump +4.0pts

- Michigan (MI): Harris +2.0pts

- Pennsylvania (PA): Trump +1.8pts

- Wisconsin (WI): Trump +0.2pts

Polling for House and Senate races is somewhat tougher to interpret, given the range of local issues that will also play into these elections. Nevertheless, current ‘generic ballot’ polling has the GOP and Democrats neck-and-neck at 45% apiece. Such a result would likely lead to the House being decided by a single-digit number of seats, while control of the Senate would also be delicately poised, albeit with a slight Republican advantage owing to independent Joe Manchin not running for re-election in the ‘red state’ of West Virginia.

Policy

Naturally, there are numerous key policy issues at stake in the election, though a close examination of each shows that – on many – there are relatively few differences, at least differences significant enough to worry market participants, between the two presidential candidates.

Monetary policy is, probably, the most important consideration for financial markets, particularly with Fed Chair Powell’s term set to expire in 2026, the same year as fellow Board members Barr and Kugler, and Jefferson’s term as Vice Chair set to expire a year later. Replacements to these key positions would need to be confirmed by the Senate, limiting the extent to which any ‘wildcard’ picks could be made, and somewhat constraining the President’s influence over the composition of the Fed – as operational independence is designed to do. Despite this independence, re-election of former President Trump would, likely, see a renewed barrage of complaints over the policy backdrop, though this social media noise should be adeptly dealt with by Powell, given prior experience, and also be limited to posts on the web, with the President’s ability to control the Fed Chair, rightly, severely limited.

Fiscal policy is the second notable area that deserves examination. Once again, the major candidates display a surprising degree of similarity here, with both sides of the political aisle seemingly willing to increase government spending, at a rapid clip, and neither showing a particular degree of concern over surging borrowing, or a widening deficit. While tax policy does differ – with Trump seeking further tax cuts, and Harris likely seeking to raise corporation tax, and taxes on the wealthier contingents of society – it sees unlikely that specific policies here will be particularly market-moving, owing to the broader direction of travel remaining the same, regardless of the White House occupant.

Trade is another region in which there are commonalities which span the political divide, with neither the Republicans, nor the Democrats, set to adopt a pro-free trade stance. Instead, protectionist policies should continue to ‘rule the roost’, albeit with Trump likely to take a harder line, particularly on China, but also on a global level, with a potential ‘baseline’ tariff of 10% on all imports one measure reportedly under consideration.

Regulation is, by some distance, the area whereby the two presidential candidates differ most significantly. It is also the area where it is, by virtue of executive action, easier to change policy in relatively short order. The difference is stark, and simple – Trump, as shown during his first term, is likely to lean significantly towards deregulation, across the board, covering a wide swathe of industries; meanwhile, Harris, while perhaps not bringing in fresh business regulation of her own, is highly unlikely to rollback any initiatives put in place by the current administration. Naturally, a lighter regulatory burden is favoured by businesses, large and small, and by market participants.

There are a range of other policy areas which are likely to attract significant attention during the election campaign, albeit unlikely to be significant stories for market participants. These include:

- Immigration: The GOP will likely take a tougher line on the issue than the Democrats though only if control of both chambers of Congress is achieved, along with the Presidency

- Healthcare: A long-running issue of debate within the US, with well-known stances on each side of the political aisle, though the matter of abortion access has taken on greater importance of late

- Geopolitics: Not a short-term market driver, though the issues of further aid to Ukraine, as well as the US’ involvement in the Middle East, remain hot topics, with Sino-US relations, particularly relating to Taiwan, also an important longer-term issue

- Climate: Trump’s vow to “drill baby, drill” has fuelled expectations that domestic oil production would surge were he to retake the White House, while a Harris presidency would likely see the ‘status quo’ maintained along the lines of climate initiatives outlined in the ‘Inflation Reduction Act’

- Guns: Another long-running issue of debate, with well-known dividing lines, whereby a Republican-led government would seek to repeal certain elements of gun control legislation, while the Democrats will likely seek a ban on assault weapons, and high-capacity magazines

Market Implications

Of course, the most important question is what all of this is likely to mean for financial markets.

For equities, the broader, medium-term path of least resistance should continue to lead to the upside, with any potential election impact likely to be most felt within specific sectors, as opposed to the market more broadly. While a Trump win, and/or a GOP sweep, would likely be the most market-friendly outcome, and result in a knee-jerk rally on election night, it’s tough to say that a ‘Blue Wave’ would be an outright bearish scenario, particularly given equity performance during the Biden Administration, even if a higher regulatory burden may, at the margin, pose stiffer headwinds.

_Daily_2024-08-09_09-36-06.jpg)

In terms of sectors, the defence sector seems primed to outperform no matter the election result, given ongoing global geopolitical tensions, which show little sign of simmering down in short order. Elsewhere, Energy may struggle under a Democrat administration, as ‘green’ policies continue to find favour, while Healthcare is also likely to face headwinds. On the other hand, a GOP-led administration should benefit the Banks, given historical leanings towards deregulation, and permitting increased capital to be returned to shareholders.

Meanwhile, in the margin FX space, one would expect a Trump win to be an immediate positive for the USD, if only in a mechanical manner owing to the significant weakness likely to be seen in currencies such as the CNY/H and the MXN on the back of such a result. That said, the margin FX market tends to care more about political stability, than the political allegiances of a particular government. Hence, a divided government – in any form – is likely to be the most USD-negative outcome from the election, at least in the short-term.

Finally, in the Treasury complex, a ‘sweep’ for either party is likely to be negative for bonds, particularly at the longer-end of the curve, given the degree of forced fiscal restraint that would be removed by having control of both chambers of Congress. As noted earlier, neither party, or presidential candidate, appears particularly perturbed by ballooning borrowing and government deficits, which will remain a negative for bonds, and raise further concerns over supply being absorbed by financial markets. While a divided congress may allay some of these concerns, it would likely bring with it a renewed pantomime over the debt ceiling, which as always will be raised – or suspended – as many times as necessary, but may drive increased market volatility in the meantime.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.