- English

- 中文版

While pro traders will continuously review their process they know the correct placement of a stop loss is a key factor to their edge.

Regardless of whether a trader is scalping off 15-minute charts or holding through a multi-day trend or momentum trade, stops should be the backbone of any successful trading process and you can trade the opportunity at Pepperstone.

Stops are market orders

By way of the technicalities, understand that a stop order is an undated market order – where should the underlying price trade into (and through) the designated stop level, an order is sent to market to enter or exit a position at the prevailing price at that time.

I say ‘enter’, because stop orders to open a trade are essential for momentum scalpers or any trader hoping to ride a continuation of a recent move or trend. For now though, we’ll focus on stop orders to exit a trade, a risk management tool.

Understand how market movement effects the fill

While we’ve seen incredible advances in the technology available to non-institutional market participants, traders need to be aware that in times of high volatility and fast-moving markets, market orders have an increased prospect of being filled at a worse price than what was stipulated as an attached order. This is commonly known as ‘slippage’.

Obviously in times of lower volatility, one would hope that slippage would be minimal and the fill (to close the position) realises at the desired stop level – however, slippage is a consideration especially for those that trade in size or in periods of illiquidity, around news or at times where spreads can typically widen.

*As an aside, it can be reassuring that Pepperstone has perhaps the best and deepest liquidity at touch in the MT4/5 and cTrader scene.

The 10 stop loss commandments

Every trader has their own set of principles and some will be profitable without using stops – but by way of a guide, here's a set of beliefs I hold and how I think of stops:

1. Some say that “a stop represents the level where I am wrong”. I see merit to this call, but more importantly the distance to my stop (pips) represents the desired level of risk I am willing to take in any one position. This can form the cornerstone for the whole trading process.

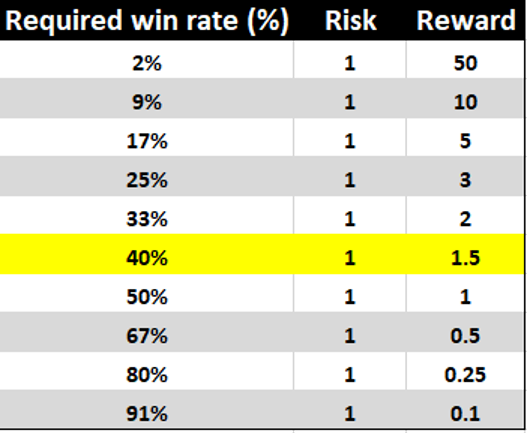

2. If I know my potential risk, I can focus on my ideal profit target – or the desired reward, although I will let a profitable trade run whenever possible. This dynamic changes depending on the strategy – Momentum scalps may target a high win rate but have a poor risk/reward trade-off. Momentum, trend and swing traders (on timeframes above 4-hour) may focus on achieving >1.5x R:R, but only have a 35%-to-40%-win rate. Either way, knowing one’s risk is key.

A trader’s equation

3. Don’t just blindly put a stop below (above) a prior swing low (high), just because it seems obvious – indeed, having a hard stop to close below obvious levels can often be to the detriment - Stops should be dynamic to the movement and volatility in the instrument – there is no factor more important in setting stops. If the timeframe you trade sees increasing range expansion, then the stop needs to be set further from entry. If the range and volatility are low (relative to recent data) one can place a tighter stop.

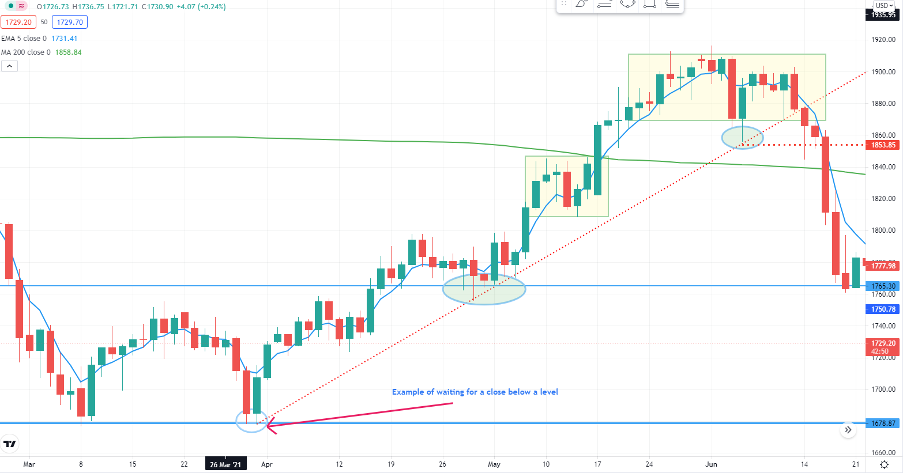

4. Discretionary traders, especially those who trade off longer timeframes, may look at exiting a trade when price closes (on that bar) above/below a specific stop level, exiting the trade at the opening price of the next bar – as opposed to using a hard stop loss. This carries risk but this technique can work well especially for those placing stops below significant levels where failed breaks can so often occur.

Here's a great example – price makes a lower low on 31 March, but closes well off the low and goes on to rally 14.2% in the coming 44 days.

(Source: Tradingview)

5. Being dynamic to volatility applies to all strategies and timeframes – discretionary or systematic.

6. The degree of risk taken in a position dictates the position size. The greater the risk, the lower the position size and vice versa. Correct position sizing (relative to the size of the account) is what keeps traders living to fight another day.

7. We can assess volatility and movement by applying indicators such as the ATR, realised volatility, standard deviation, Keltner or Bollinger Bands. However, there are many other ways that price range, realised or implied movement can be measured.

8. Don’t dwell on stops being hit. Losing is a simple fact of trading. Learn to be ok with losing – what’s important is that you take the loss. Amateur traders go broke taking big losses, that is, relative to the size of the account.

9. Quickly learn that taking a loss is relatively straightforward – for discretionary traders the hard part is holding and extracting the most from winning trades. Deal with loses quickly or let the stop take care of it.

10. Never ever trade your P&L – moving a stop to breakeven just because this is a point where you can’t be wrong is often a clear sign you’re doing this, and not focusing on trading price or the flow.

While some will disagree with these, in my strong opinion a stop-loss will keep you in the game for longer – it's there to help you understand your risk and from here we can understand the targeted profit level and position size within the strategy. It can keep you honest and refocus that you’re trading the tape, reacting to behaviour and flow, and that the market will take its pound of flesh – it keeps you humble.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.