- English

- 中文版

The fundamental backdrop supports being short, with concerns about the recent ruling from the German Constitutional Court likely to keep the EUR offered. As is the case with raging equity markets, which still have upside if you look at positioning and this suggests funding currencies will remain under pressure.

I lay out the bullish case for equities in this article - However, equities look solid as I lay out here.

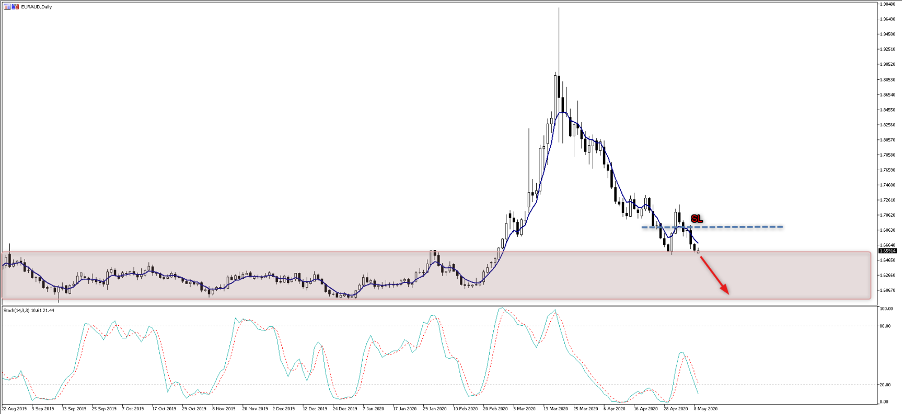

In the video, I lay-out the trade rationale, with a focus on the technical set-ups in the US500, AUDUSD and EURAUD, which in my view all suggest a probability of further AUD outperformance. By way of managing risk, trailing a stop to exit only when price closes above the 5-day EMA seems tactically prudent. Because if this pair cracks it could resume its bear trend and the short-term average should define this move.

The risks

Like any discretionary trade, the potential risks can be considered ahead of the entry. I am running an impulsive trending stop; in case we see a failed break and a reversal in price. A reversal in equity sentiment would certainly promote short covering, and maybe that plays out through renewed concerns of a COVID-19 spread once economies open. Perhaps it’s a factor to do with liquidity, with a raft of Fed speaker due this week the catalysts are there.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.