- English

- 中文版

Looming recession

Japan’s economy contracted at an annualised 7.1% in 4Q 2019, worse than the initial estimate, escalating concerns about its technical recession.

The coronavirus is now casting a shadow over the economy. Although the number of infections is relatively low compared to South Korea and China, the country’s approach to testing is in question as only small numbers so far have been screened for the virus.

Whether Tokyo 2020 Olympic games will go forward on schedule (24 July) will become a symbolic measure of whether the virus is well under control around the world. Having spent 1 trillion yen (around $9 billion) for the event, Japan would face a tremendous loss, both economically and politically, if it were to be postponed or canceled.

Stimulus in place

Japan has announced a 13.2 trillion yen ($121bn) package last December to support the economic recovery from the natural disaster and sales tax impact.

Last month, the government unveiled up to 500 billion yen low-cost loans to affected companies, which has been increased to 1.6 trillion yen this week, with the package including 430.8 billion yen in fiscal measures aimed at helping medical professionals and those affected by school closures.

Lower rate?

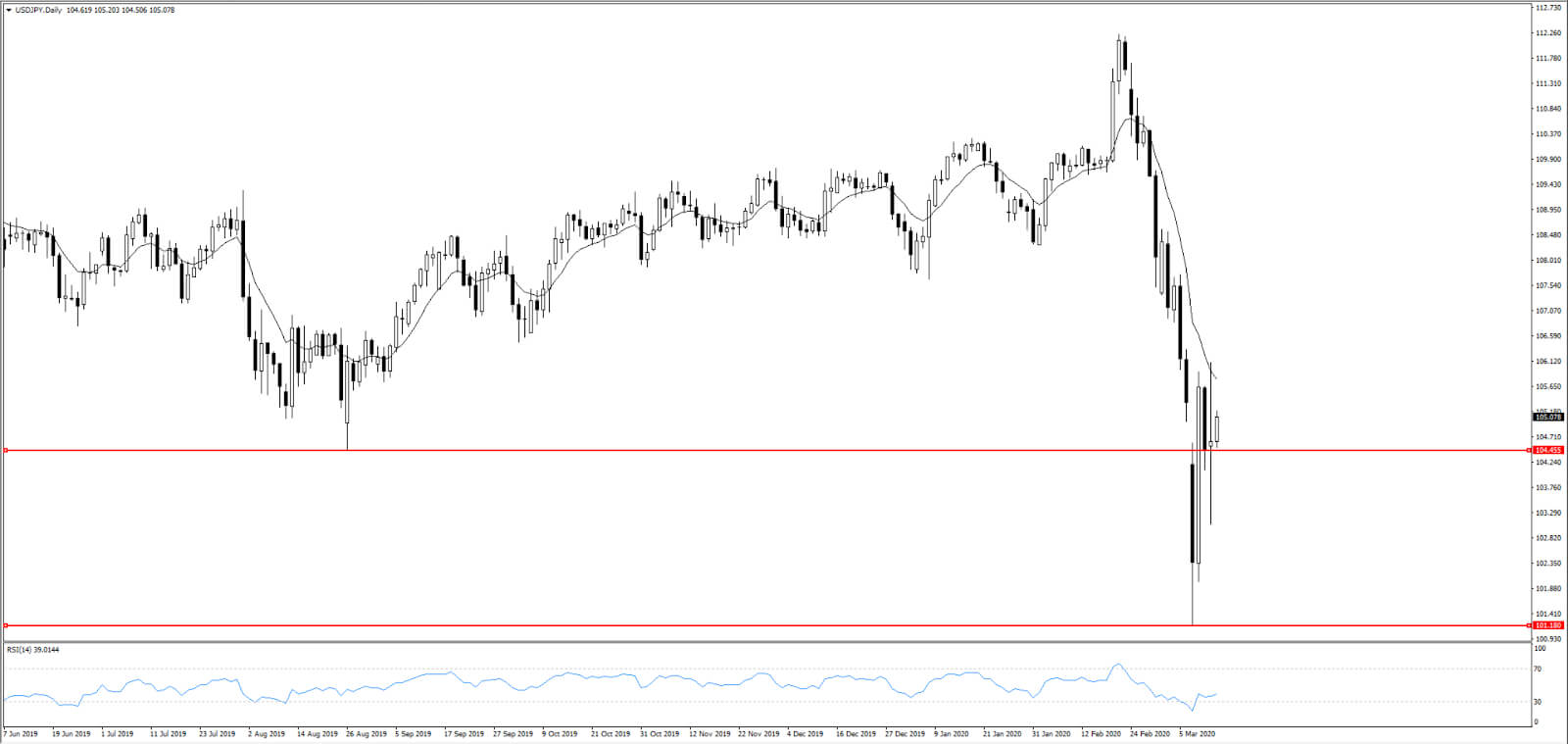

JPY has strengthened to 101.18 per dollar on March 9, its strongest level since November 2016. The recent surge is driven largely by the demand for safe-haven assets amid uncertainty over coronavirus outbreak and falling US Treasury yields.

The BoJ will not be happy with the one-sided JPY moves and said it ‘won't hesitate to take additional steps if needed’, yet there is not much they can do about it.

Given the adverse impact on commercial bank’s earning, the BoJ is less likely to lower the rate further into negative territory (currently -0.1%). As any direct intervention on the margin FX market will draw the attention of the US Treasury Department, who has put Japan on its currency watch list, it would be a last resort to suppress the volatility should the rate move to an extreme level.

As USDJPY one-month implied volatility is sitting at the highest level since 2009 and as the global panic elevates, the pair might easily retest the multi-year low 101.18 or even the 100 psychological level in the short term. It's also interesting to see price action around 104.45, where the pair have been battling for a few days. Will that become the next support level?

What to expect?

The ECB is a good guidance. The ECB on Thursday kept rates on hold, while it announced an additional LTRO and €120 billion more assets to purchase, to provide liquidity in the financial system.

Therefore, increasing ETFs and JGBs purchase are more likely options for the BoJ to provide ample liquidity and ensure stability in financial markets, without making any formal changes to its policy framework.

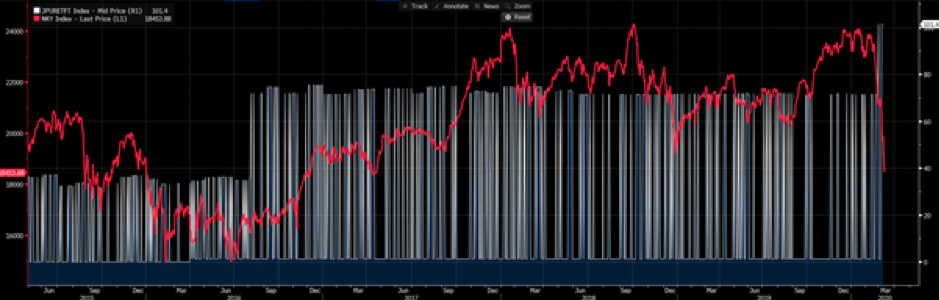

The BoJ has plenty of room to ramp up asset purchases. As of the end of January, ETF purchases over the past 12 months was 4.4 trillion yen, well below the annual target of 6 trillion. The net purchase of JGBs over the same period totalled 15 trillion, far below the annual guideline of 80 trillion yen.

The record-high of 100 billion yen ETF buying (white) last week failed to boost the Nikkei 225 (red, JPN225 on MT4/5), which has lost more than 20% from the February highs.

BoJ’s ETF buying (white) & Nikkei 225 (red)

Source: Bloomberg

The BoJ is therefore expected to lift the EFT purchase limit and reinforce the JGBs purchase in the upcoming meeting to breed confidence into the share CFD market (JPN225).

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.