The Daily Fix – King USD finds inspiration from rising Treasury yields

- AUD in focus as we look towards the RBA deputy Gov speech

- Asia equity opening calls looking soggy

- US equity closes higher, with Amazon and Tesla attracting the flows

- Focus switching to US politics with the first Presidential debate ahead

- Gold eyes a test of the range lows

Perhaps the biggest debate I’ve fielded with colleagues and clients is whether the RBA hike in the August meeting – it strongly divides opinion, where opinion seems skewed depending on the individual’s own circumstances and whether they have a mortgage. The Aussie interest rate futures concurs with this sentiment, with 12bp of hikes priced for the August RBA meeting, and the market now awaits the June employment report (18 July), and the Q2 CPI report (31 July), for the RBA’s call to be truly influenced.

We may well get some needed clarity and steer on yesterday’s Aus CPI report, and how it feeds into RBA’s thinking later today when RBA deputy Governor Andrew Hauser speaks at 20:00 AEST - so an event risk for traders, as this could put further volatility into Aussie rates and the AUD.

Until we get that guidance from Hauser, the broad market view aligns with the anecdotal debates I’ve had, with pricing implying an August hike at 50% – that pricing is supporting the AUD, notably vs the GBP, JPY, and NZD – where we’ve seen upbeat flows. It is also seemingly a headwind for the ASX200, which is set to open 1% lower, with SPI futures sold all through European trade, and failing to bounce, despite the S&P500 cash market finding buyers into the close.

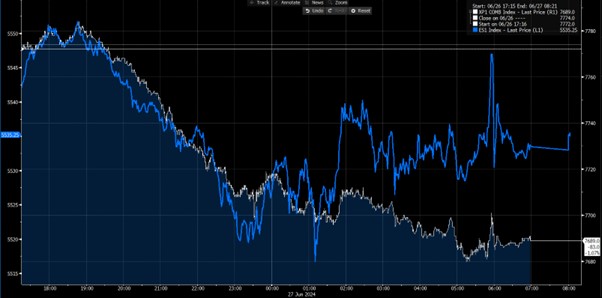

White – Aus SPI futures, Blue – S&P500 futures

I hear that a 25bp hike will crash the Aussie economy – I do, however, question that view, and while consumption will no doubt be impacted by higher real policy rates, most households will begrudgingly price in the additional cost and move on – psychologically a hike will hurt, but there is a stark difference between a token 25bp hike and that of a hiking cycle – Clearly if the average household felt the RBA were to start a series of hikes it would cause real change in spending behaviours, but that is highly unlikely.

Our opening calls for Asia are for lower levels, although the net change in the S&P500 (+0.2%) and NAS100 (+0.3%) does offer Asia some support. That said, 66% of S&P500 stocks closed lower, and we see materials, financials and energy sectors closing in the red, so the read-through is poor – and as we have seen in the tape of SPI futures, global capital does not want to be centred in a market where the central bank could be looking to restrict policy and we could see higher real policy rates.

At a stock level, Tesla (+4.8%) has found some good flow and regardless of what I think of the stock, the market is warming to whatever they see, and the price action looks bullish – a push higher seems more probable than not, and we’ll see how it fares if we see a move into big resistance seen between $205.64 to $206.77. Amazon (+3.9%) is another name getting a work over from momentum accounts, and this is raging hot, and longs look towards $200. Apple (+2%) has found good buyers, and the skew in positioning is for a pushback towards $217.

The US Treasury market gets attention with yields 7-8bp higher across the 5-30yr maturities. The US 10yr Treasury has held a range of 4.20% to 4.30% in recent times, but we see sellers taking yield higher and out of that range, and the result has been a decent steepening of the 2s v 10s curve. A big USD positive it seems, and the USD has worked well on the day, where we’ve seen upbeat flows vs the GBP and JPY, although the big USD moves have come against the high beta Latam currencies. USDJPY certainly gets some airtime as we approach ¥161, and few seem to be expressing concerns about an imminent JPY intervention from the MoF.

GBPUSD sits at 1.2621 and prints the lowest close since mid-May – rallies, it seems, are to be sold and the trend is lower here.

EURUSD holds below 1.0700 and the lows of the recent range, where momentum traders will be looking at short entries on a firm break of 1.0667. Taking a broader view, we see the DXY tracking in a bullish channel on the daily timeframe, with trend resistance (drawn from the October high) in play and being tested.

There will be a focus on the US first Presidential debate at 9 pm EDT, although I am sceptical this event moves markets to any great degree. However, it could be important in setting the scene as we roll towards 5 November. We know it will last 90 minutes and set up are for microphones to only be on when either Biden or Trump are due to speak – so no interruptions, which could favour Biden’s prospects. Biden will be out to make a statement and show voting America that he is the man for the job, despite concerns about his age and health, and as we saw in the State of the Union speech a good performance could boost his polling.

As it stands Prediction markets have Trump firmly favoured to take the White House, although the national polling averages are far closer. By way of example, the FiveThirtyEight national polling average has Trump at 40.8% and Biden at 40.9%, while RealClear has the polling average at 46.5% and 45.2%, respectively.

The moves in US treasury yields and the stronger USD have impacted gold, and we see the XAUUSD price breaking rising trend support (drawn from the 10 June low), with shorts now looking for a retest of the multi-month range lows of $2283 – one for the radar, as a break of $2283 would be significant. We can look at XAUAUD too given the strength in the AUD, and see a breakdown here, and I like this traded from the short side – it's also not a great input for Aussie gold miners, who will face headwinds on open today.

Elsewhere, crude +0.1% despite reports showing inventories are the highest since April. Copper is flat, while Dalian iron ore futures have found a bid and sit up 2.2%.

Good luck to all,

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.