A Trader's Week Ahead Playbook: US CPI, RBA Meeting and Earnings Posing Risk

The process of managing risk throughout the week, not just in a position or into for an emerging opportunity, but mentally and psychologically, is also a critical aspect within the trading process. Therefore, reviewing the upcoming key event risks and themes – both scheduled and probable (unscheduled), that could impact sentiment and the intraday price action (in a market), makes the job of managing risk more efficient.

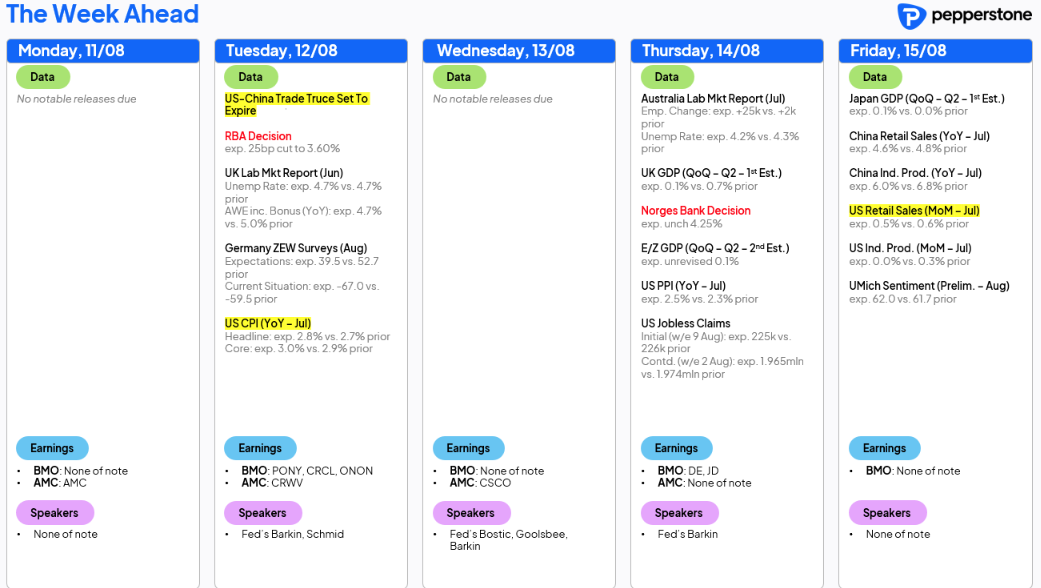

The high-level risk events this week

All eyes on Nvidia - The NAS100 led the charge, but can the positive flow build?

We roll into the new trading week with sentiment frothy, risk well bid, crypto flying high (Ethereum has broken out to the best levels since 2021), and implied levels of cross-asset volatility at YTD or at multi-year lows. The NAS100 went on a tear last week, closing +3.7% w/w and at an all-time closing high - longs hold will hold a positive expectancy for new absolute ATHs to come into play, as they do for the S&P500.

That said, there will be close focus and possible headwinds early this week to the US AI sector, given reports that Nvidia and AMD are set to pay 15% of revenues sourced from China to the US Administration - this comes amid calls from Chinese state media that Nvidia’s H20 chips pose a national security risk, raising the prospect of import controls.

EU equity has regained form with the EU Stoxx 50 index closing higher on each consecutive day last week. Whether this positive flow is impacted by developments from the Trump/Putin meeting in Alaska is yet to be seen, but it seems unlikely.

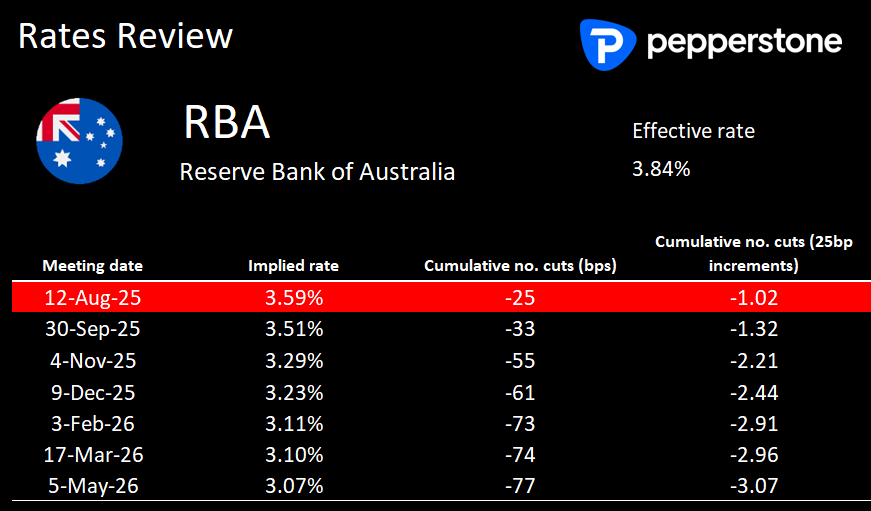

Trading Australia: The RBA meeting & CBA’s FY2025 earnings dominate

The ASX200 spent much of last week at or near ATHs, although the risk ramps up this week, and traders need to be alert and consider the propensity for intraday volatility and movement given the tier one risk in play. On Tuesday, the RBA are almost certain to cut the cash rate by 25bp (to 3.60%) – an outcome fully discounted by Aussie interest rate futures/swaps, and by extension ASX200 equity valuations and the AUD… subsequently, the move in markets this week likely comes in reaction to the tone and the appetite seen in the RBA’s statement and Gov Bullocks presser to keep reducing the cash rate towards neutral, as well as any increased concerns on the labour market.

We also navigate the Australian July employment report on Thursday (consensus: 25k jobs, U/E rate at 4.2%), and to a lesser extent, Q2 wages (Wednesday) - the outcomes of which could help steer rates pricing and expectations for the September RBA meeting.

Aussie equity and AUS200 traders are set to take on a deluge of ASX200 corporate earnings throughout the week. That said, it will be the Wednesday session that garners the closest focus, where we see close to $400b of ASX200 market cap set to report. CBA will dominate the market's focus on Wednesday, as you’d expect given its reach into the domestic economy, and the incredible valuation premium it commands relative to other global banks.

With a punchy 11% weight on the ASX200, CBA could have a significant influence on the broad equity index, especially if the reported numbers and the guidance filter through to outsized moves in ANZ, WBC and NAB. Consider that CBA options pricing implies a -/+2.3% move on the day of reporting, which, if realised – in isolation - would move the ASX200 by -/+0.3%.

Tencent’s earnings and China’s data flow set to impact the HK50

The HK50 and A50 indices were relative laggards last week, with the price action lacking the upside momentum seen in NAS100, EU Stoxx or NKY225. On the docket this week, we see China's new yuan loans (credit data), home sales, retail sales, and industrial production. There seems to be a growing view that traders want to buy China risk; they just need more of a reason to do so. Subsequently, good numbers in the data flow could see China/HK outperform.

Earnings announcements from HK/China corps will again be a clear driver of single stock pricing, with the biggest weight on the HK50, Tencent, set to report earnings on Wednesday. The options implied move on the day of reporting are -/+2.9%, so again, this could impact the price action at an index level.

The USD eyes US core CPI

In FX circles, the USD remains a tough trade with the technical set-up in the DXY providing no clear directional bias and offering two-way risk for the week ahead, at least on the higher timeframes. In the options space, G10 FX 1-week implied volatility sits below the 10th percentile of the 12-month ranges, reflecting the low-released volatility seen on a daily close-to-close basis and the lack of any impulsive moves or discernible trends.

FX (and gold) traders became familiar with Stephen Miran’s temporary appointment as a Fed governor – a factor that almost assures three votes for a cut at the September FOMC meeting. That stance is known even before the outcome of this week’s US core CPI release and the August payrolls report (released 5 Sept). The July US core CPI print (on Tuesday) will therefore be the marquee scheduled risk this week, and while the economist’s consensus is for a 0.3% m/m rise in core inflation, all eyes will be on the degree to which core goods inflation is affected by tariffs and whether these same factors could be even more pronounced in the August CPI read.

GBP outperformed last week – Jobs & wages in view

GBP was the best performing G10 currency last week, finding form post the BoE’s hawkish cut, with GBPUSD pushing to 1.3450 and joining GBPCAD in closing higher for six consecutive days. Tactically, many will find it an unattractive proposition chasing GBP upside given the stagflationary economic backdrop that evolves.

UK employment and wages, and Q2 GDP pose a risk to GBP positions this week, but with market pricing implying the BoE is firmly on hold in September, with the next live meeting seen in November, one considers how much this data will affect that pricing, and by extension, the GBP.

Tariff headlines won’t be far away

Tariff headlines will offer some degree of risk, with the US-China truce set to expire on Tuesday. The market has fully subscribed to the high probability of the tariff truce being rolled over for another 90 days, and as such, unless diplomatic talks fully break down, news of extension shouldn’t move markets too intently.

The gold market is also keenly watching any further news flow around the treatment of gold exports from Switzerland to the US, and if there are any new surprises on the exemption of the 39% headline tariff. The unfolding news flow on Friday saw huge gyrations in CME futures, with blows outs in the fair value/basis relative to spot gold (XAUUSD) – Things have settled, and gold traders will revert a significant degree of their attention to moves in the USD, US swaps, real rates and the event risks that could drive this week – Trump, as we know, can be unpredictable and there is an element of residual risk for the gold futures market early this week.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.